Solo 401k contribution calculator

General guidance on participating in your employers plan. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit.

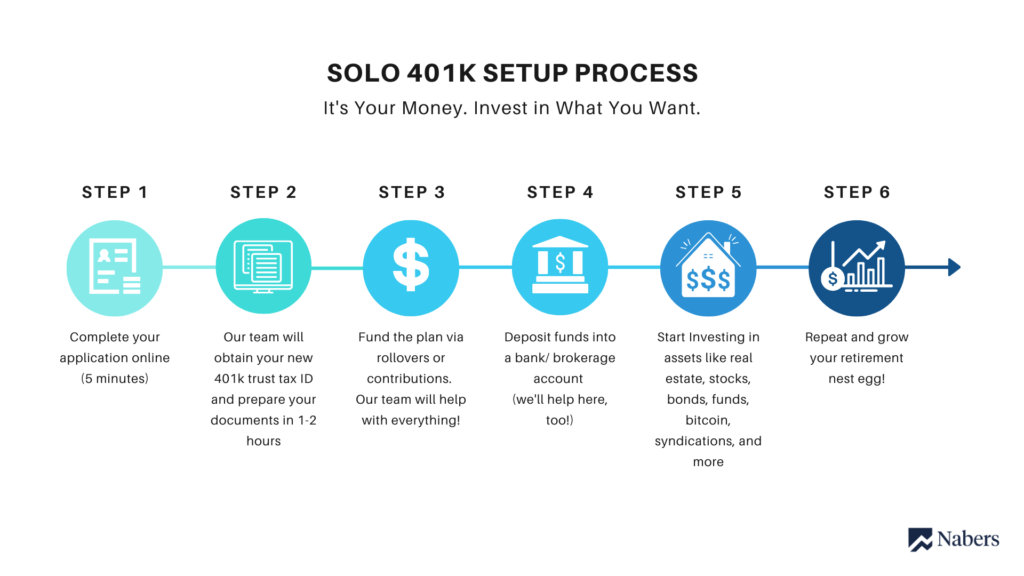

Solo 401k Setup Process Solo 401k

Contribution percentages that are too low or too high may not take full advantage of employer matches.

. If you are asking if you can take a distribution non-conversion from the Roth solo 401k that was funded through the conversion of solo 401k voluntary after-tax contributions instead of transferring the funds to a Roth IRA yes you can provided you have both had the Roth solo 401k for 5 years and have reached age 59 12. But still the Roth IRA is your best bet if you dont have access to 401k or even if youre employer doesnt offer a 401k match. Our rollover specialists can walk you through the process from start to finish provide an overview of the broad.

A Solo 401k plan a SEP IRA a SIMPLE IRA or a Profit Sharing plan. The 2022 Solo 401k contribution limit. 401k Checklist PDF Helps you keep your 401k plan in compliance with important tax rules.

A catch-up contribution of for if you are 50 or older. Solo 401k Contribution Calculator. Solo 401k Calculator 9.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Based on the testimony of a DOL expert rates considered reasonable by the DOL for loans. Consider this type of plan if your business has irregular profit patterns.

Lifetime Income Illustration Tool. Employee contributions are tax-deferred and employers must make either a matching contribution or a nonelective contribution. The Solo 401k is a retirement account and is tax-deferred therefore there is no tax return due for a Solo 401k plan.

A self-directed SD 401k sometimes called a solo 401k is a. Use the solo 401k retirement calculator to calculate the maximum annual retirement contribution limit based on your income. Deadlines for Contributing to Your S-Corp 401k 10.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. You can contribute 25 percent of your income up to a total contribution of 54000. Employees 50 years and older are allowed a 6500 catch-up contribution in 2022 which is unchanged from 2021.

Greater control over withdrawal timing. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer. Contribution Limits of an S-Corp 401k 7.

There is a catch-up contribution of an extra 6500 for those 50 or older. Employee and employer contributions cant exceed 61000 or 100 of the employees total pay in 2022. This is why a Solo 401k is most suitable for self-employed individuals or a business owner with no additional employees other than a spouse or a child.

Get a quote 844-912-3742 Start Quote. An employee contribution of for An employer contribution of 20 of your net earnings from self-employment and. Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account.

Alternatives to Solo 401k. Its a traditional 401k plan covering a business owner with no employees or that person and his or her spouse. This type of plan can be an attractive option for small businesses since it requires.

Operate and Maintain a 401k Plan. Key Benefits of Solo 401k Plans. Less paperwork than.

These plans have the same rules and requirements as any other 401k plan. What is a reasonable rate of interest for Solo 401k loans. Start Quote Launch Self.

Solo 401k Youll need your own business to take advantage of the solo 401k and have no employees other than a spouse but its a powerful savings vehicle if you have a side gig. Each option has distinct features and amounts that can be contributed to the plan each year. If you have less than 250000 in your 401k plan nothing needs to be filed.

Step 7 Use the formula discussed above to calculate the maturity amount of the 401k. Operating a 401k plan. Retirement services planning.

Solo 401k Solo-k Uni-k. Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. And the contribution limit is pretty low 6000 a year7000 if youre 50 or older when you compare it to the 401k limit 20500 a year27000 if youre 50 or older.

The one-participant 401k plan isnt a new type of 401k plan. Once you have 250000 or more in total plan value add up all your assets and cash in the plan you will file form 5500-EZ. As long as the Solo 401k loan interest rate is consistent with the interest rate charged by commercial lenders for a loan made under similar conditions the interest rate is considered reasonable.

Contribution and Eligibility Calculator. Solo 401k contribution limits The total solo 401k contribution limit is up to 58000 in 2021 and 61000 in 2022. Salary Deferral Contribution In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can.

Your 401k rollover made easier. Mid-year Amendments to Safe Harbor 401k Plans and Notices. Correct a 401k Plan.

The annual Solo 401k contribution consists of a salary deferral contribution and a profit sharing contribution. Solo 401k SEP IRA. Step 5 Determine whether the contributions are made at the start or the end of the period.

Specifically you are allowed to make. Contribution limits in a one-participant 401k. The maximum 401k contribution for employees under 50 years of age is 20500 in 2022 up 1000 from 2021.

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Small Business Credit Cards Travel Rewards Credit Cards

Solo 401k Contribution Limits And Types

Solo 401k Contribution Calculator Solo 401k

Retirement Savings Chart Retirement Calculator Retirement Savings Chart Savings Chart

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

Solo 401k Contribution Limits And Types

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Solo 401k Contribution Limits And Types

Solo 401k Contribution Calculator Solo 401k

Ira Financial Group Introduces Additional Features To Solo 401 K Annual Contri Refinance Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Solo 401k Contribution For Partnership And Compensation

The Solo 401k The Entrepreneur S Guide To A Powerful Pension Plan How To Plan Types Of Planning 401k

2020 2021 Solo 401k Contributions How To Calculator S Corporation C Corp Llc As S C Corp W 2 Youtube

Solo 401k Contribution Limits And Types

Solo 401k Contribution Calculator Solo 401k